47+ does applying for a mortgage hurt credit score

This is because other creditors realize that you are only going. Easily Compare Lenders Apply Today.

Does Applying With Multiple Mortgage Lenders Affect Credit Score

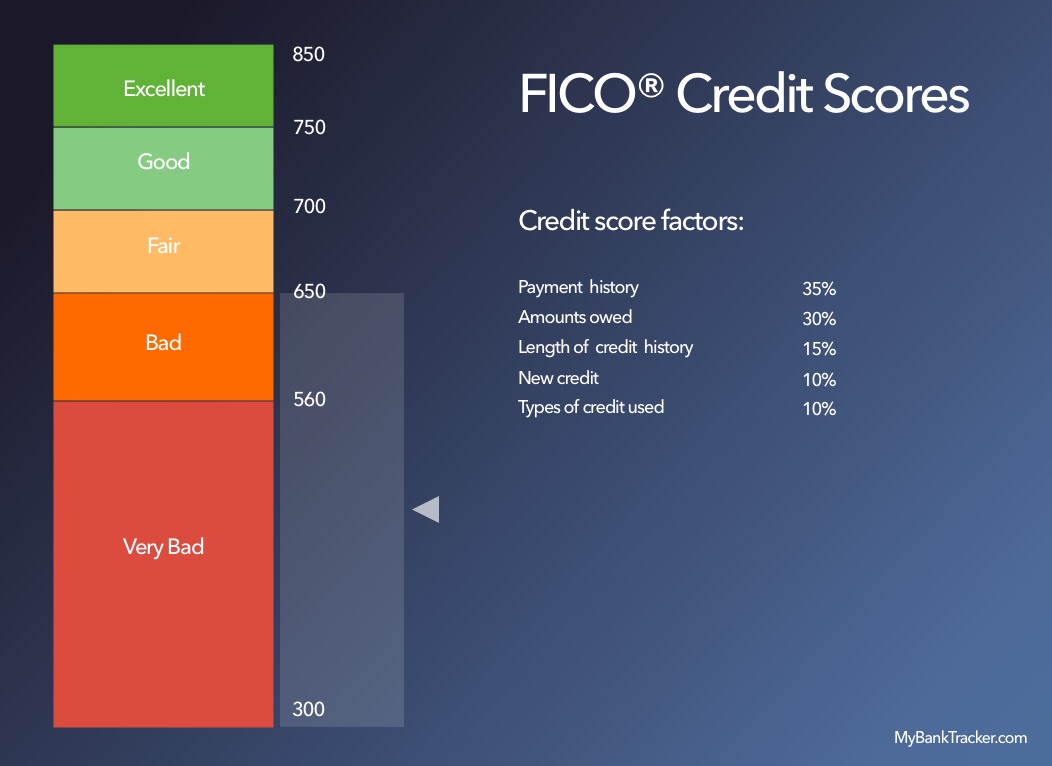

Web A person with a 760-850 FICO score could secure a 30-year fixed mortgage with a 4147 interest rate.

. Web Keep in mind however that refinancing a mortgage does come with closing costs including an origination fee appraisal costs title insurance and credit reporting fees. Find the Best Mortgage Lender for You. Because you are searching for just one loan each of the credit pulls from different lenders will count as just one hard.

Lower interest rates make a big difference to the monthly mortgage payment. Web Just how much can you save when you refinance with a high credit score. Web Web Assuming nothing in a mortgage application changes except the credit score someone with a score in the 680-699 range would have a mortgage rate.

There are soft inquiries and hard. Web Here is a list of five things you should avoid after applying for a mortgage. Web Your credit score wont drop because of the loan application and it wont make it harder for you to get approved.

Web You can shop around for a mortgage and it will not hurt your credit. Furthermore the average approved mortgage applicant comes up with a 21 down payment has a monthly payment equal to 21 of household income and rocks a total debt to income DTI of no. We ran a sample.

Your mortgage application could be disqualified for several reasons and not just because of purchases related to your home. This rate is more than 06 percentage points lower than the 476 interest rate for a person. Web Once your complete your mortgage application your lender will check your credit report at all three of the major US.

Lenders may be wary. Apply Now With Quicken Loans. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

This type of inquiry shows up on your credit file and it can affect your credit score. These costs often add up. Web Mortgage refinancing can affect your FICO credit score in a few different ways according to credit.

A credit monitoring service could quickly alert you to changes in your credit. Ad Compare Mortgage Options Calculate Payments. Web While getting prequalified for a mortgage might not affect your credit scores you want to make sure other negative marks dont hurt your credit right before you apply for such a large loan.

Ad Calculate Your Payment with 0 Down. Web A mortgage pre-approval affects a home buyers credit score. Applying for other lines of credit car loans credit cards personal loans while shopping for mortgage lenders.

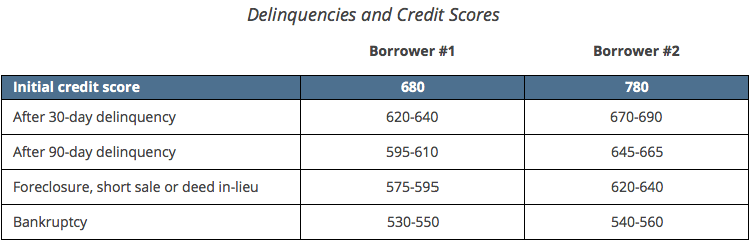

Borrowers saw an average credit score drop of 204 points after getting a mortgage. It took an average of 165 days after closing for credit scores to reach their low points and another 174 to rebound. This type of credit check is called a hard inquiry and it can temporarily lower your credit score.

Were Americas Largest Mortgage Lender. Viewing your own credit scores. FICO has a page on its website that lets you compare the costs of a mortgage depending on your credit score.

You will be able to see. Web The average credit score for approved mortgages is 762. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

The 45-Day Window Thirty days after youve made the first application all the applications made within a period of time are treated as a. Investing in large purchases. The pre-approval typically requires a hard credit inquiry which decreases a buyers credit score by five points or less.

Lock Your Mortgage Rate Today. Web Applying for a mortgage with multiple lenders wont hurt your credit score nearly as much as these things will. Web If you apply for a mortgage loan with several lenders in a short period your score wont drop every time these lenders check your credit.

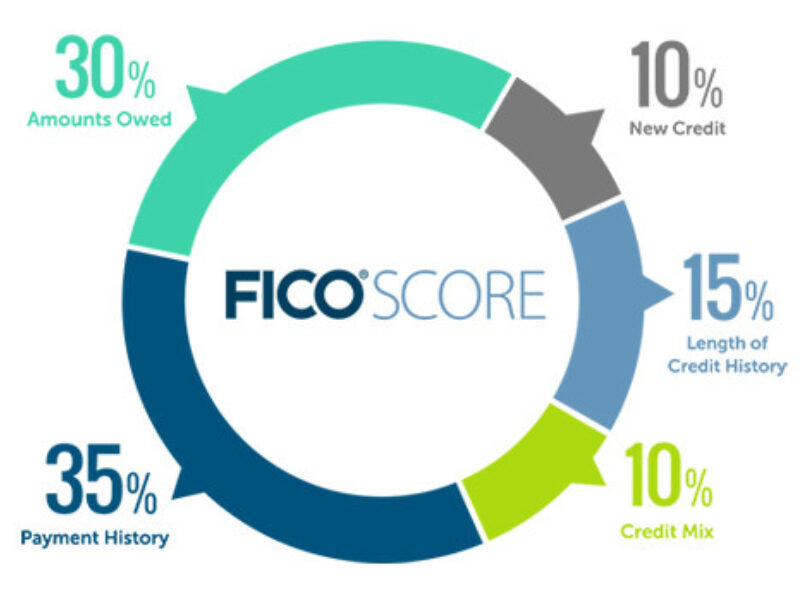

Your ability to obtain and maintain new credit 10 of your credit score This last factor called new credit is the one that can be affected by applying for new loans but that depends on what type of inquiry were talking about. Web First when you apply for a mortgage loan lenders will make whats called a hard inquiry A hard inquiry means that the lender pulls your entire report and scores your credit. Within a 45-day window multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry.

Web A study by LendingTree found that US. Web These rates can be a full percentage point and a half lower than the rate offered to someone with a credit score of 595. Compare Offers From Our Partners To Find One For You.

Web A soft credit inquiry which is used during the prequalification process does not affect credit scores so there is no risk in trying to find out whether youre at least in the ballpark for approval for a specific loan or credit card. A pre-approval is the first big step towards purchasing your first home. Web If your credit score is 740 and you qualify for a 65 percent interest rate youll pay 2212 per month principal and interest only and 446583 in interest over the life of the loan.

Ad All You Need to Take the Best Home Loan For You.

How Foreclosure Impacts Your Credit Score Apr 22 2010

How Applying For A Mortgage Will Affect Your Credit Score

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

How Mortgage Applications Affect Your Credit Score The Mortgage Hut

How Does A Mortgage Application Affect Your Credit Score

How Do Multiple Credit Cards Affect Your Credit Score Axis Bank

When Applying For A Home Loan About How Much Does Your Credit Score Drop Quora

What Credit Score Is Needed To Buy A Home

How Many Times Can You Pull Credit For A Mortgage

What Is Loan Settlement It S Impact On Your Credit Score Axis Bank

How Mortgage Applications Affect Your Credit Score The Mortgage Hut

Does Applying With Multiple Mortgage Lenders Affect Credit Score

How Applying For A Mortgage Will Affect Your Credit Score

7 Biggest Factors That Pulls Down Your Credit Score Axis Bank

How Checking Account Impacts Your Credit Score Mybanktracker

Does Applying With Multiple Mortgage Lenders Affect Credit Score

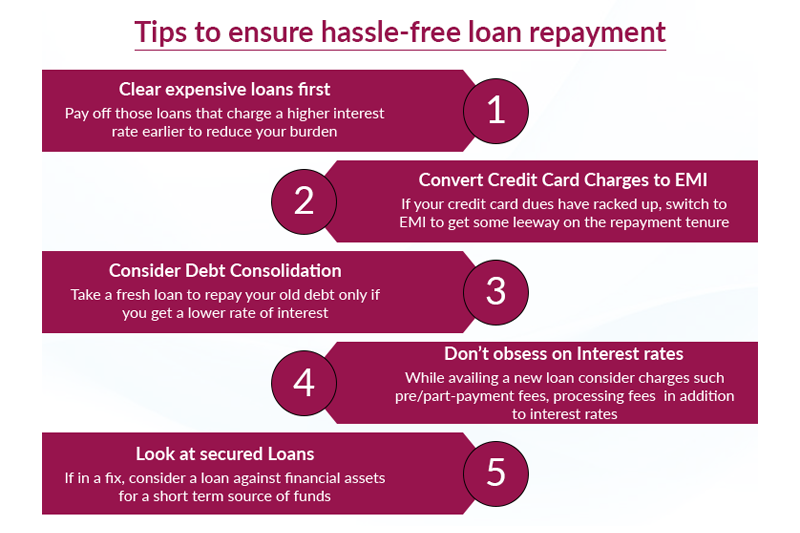

Five Tips To Follow When Planning Loan Repayment